In which Dr. Oz once again proves himself to be a gaslighting, disingenuous grifter.

Yesterday morning, Dana Bash of CNN’s “State of the Union” briefly interviewed Mehmet Oz, Administrator of the Centers for Medicare & Medicaid Services (CMS).

From the transcript:

OZ: We have seen in the ACA marketplace where there was a baseline 83 percent subsidy, that, when you take away the extra 5 percent, which is what the enhanced premium subsidies represent, it doesn't really affect enrollment.

In fact, we're still roughly at around 23, 24 million people. And that's despite the fact that all the fearmongers were saying, we're going to lose eight, 10, 12 million people. No one seems to have left the exchange.

This is exactly the sort of garbage claim that I predicted Oz would be trying to spin back in December:

...I’m bringing all of this back up again today because I strongly suspect that the situation is about to reverse itself, with the Trump Administration already preparing to brag about impressive-sounding ACA enrollment numbers for 2026 in spite of the enhanced tax credits expiring less than 60 hours from now...even though the actual negative impact of the expiring tax credits (along with several other administrative policy changes made by CMS this year) likely won’t be known for several months after Open Enrollment officially ends in January.

...CMS is unlikely to actually publish that data until sometime in July 2026 if at all, so any crowing by the Trump Administration, Congressional Republicans or their allies about the tax credits expiring having a “minimal impact” etc. should be taken with a massive grain of salt until then.

In fact, Oz’s lies were even more egregious than I expected:

- Total 2026 OEP plan selections stand at 23,037,792 with only perhaps 20,000 or so enrollees still to be added from a handful of states. This isn’t remotely close to “24 million,” so right off the bat he’s exaggerating.

- More importantly: I don’t know of anyone who claimed that ACA exchange enrollment would drop by “8, 10, 12 million people” in 2026 specifically.

As I explained in my takedown of an absurd WSJ editorial last month:

- The Congressional Budget Office (CBO) projected a net drop of 3.9 million year over year from 2025 to 2026…and again, that was for average monthly effectuated enrollment, not OEP plan selections.

- The Urban Institute projected a net drop of 7.3 million subsidized enrollees…which isn’t the same thing as total enrollment. For instance, in 2025 there were 1.64 million enrollees who earned more than 400% FPL, all of whom lost subsidy eligibility…but some of whom are still enrolled (my own family is likely to be among them, in fact).

Many more below 400% FPL also lost subsidy eligibility…millions of whom were forced to downgrade to a worse plan with much higher deductibles & out of pocket expenses…as I noted last week.

So, how much will ACA exchange enrollment drop this year?

Again, we likely won’t know for sure about even the first quarter of the year until July or so, but right now it looks likely to be a minimum of 1.4 million but could be as many as 4.1 million people or more…which would be a bigger drop than the CBO projected.

Believe it or not, it wasn’t Dr. Oz lying about actual ACA enrollment which really caught my attention; I had already accepted that he was gonna lie through his teeth about that when I posted my warning back in December.

It was his response to the next question which caused steam to come out of my ears:

BASH: …can you give me one specific example of a solution that the president has put forward that is lowering the cost of health insurance and health care costs beyond prescription drugs?

OZ: There's something called a CSR, which is a way of making sure that insurance works more efficiently.

The Affordable Care Act is a good example of this. These were in the original Working Families Tax Cut legislation, was taken out by the Democrats for reasons that are unclear to me because it seems like it's better for everybody. It will drop premiums 10 percent to 11 percent across the board.

So I'm giving you an insurance hack that works to reduce insurance premiums for the American people 10 percent to 11 percent. We want it back in. We want that to -- it was -- again, it was originally designed and supposed to be in the Working Families Tax Cut legislation. We want that back.

PRACTICALLY EVERY WORD HE UTTERS IN THIS RESPONSE IS UTTER HORSESHIT.

For starters, “something called CSR” is not “a way of making insurance work more efficiently.”

CSR stands for Cost Sharing Reduction subsidies. The CSR program has literally been a part of the Affordable Care Act since 2014.

- The ACA includes two types of financial subsidies for individual market enrollees through the ACA exchanges.

- One program is called Advance Premium Tax Credits (APTC), which reduces monthly premiums for low- and moderate-income. APTCs are the subsidies which were substantially beefed up from 2021 - 2025 by the American Rescue Plan & the Inflation Reduction Act thanks to Democrats & President Biden…but which expired on New Year’s Eve last December.

- The other type of subsidies are called Cost Sharing Reductions (CSR), which reduce deductibles, co-pays and other out-of-pocket expenses for low-income enrollees who earn up to 250% of the Federal Poverty Level (FPL), but only if they enroll in a Silver plan.

- The way the CSR program worked until 2018 was a bit unusual. Unlike premiums, which are a set, known dollar amount for every enrollee each month, the CSR program involves deductibles & co-pays, which can vary greatly from month to month.

- Until 2018, the insurance carriers, which are contractually required to cover the given portion of the enrollee’s deductibles, co-pays etc. up front, would submit their CSR expenses to the federal government on a monthly basis after the fact to be reimbursed.

So what changed in 2018?

Well, that requires jumping into the Wayback Machine:

- In 2014, then-Speaker of the House John Boehner filed a lawsuit on behalf of House Republicans against the Obama Administration, claiming that the CSR payments were unconstitutional because they weren’t explicitly appropriated by Congress in the text of the ACA (even though the program itself was described in detail, including the payment mechanism.)

- A long legal process ensued, the end of which resulted in a federal judge ruling in the GOP’s favor and ordering that CSR payments stop being made...but also staying that same order pending appeal of her decision by the Justice Department (which was still run by the Obama Admin at this point).

- After Donald Trump took office in 2017 and placed Jeff Sessions into power as Attorney General, he started publicly threatening to “blow up”/destroy the ACA exchanges by “cutting off” CSR payments.

- He did this month after month from March 2017 through October 2017, when he finally made good on his threat...by having the Justice Dept. drop the appeal of the court decision on the CSR lawsuit.

LET ME REPEAT THAT: Donald Trump and House Republicans are the ones who ENDED CSR payments in the first place.

But then…something ironic happened.

After Trump cut the payments off, many of the insurance carriers, state-based ACA exchanges and state insurance commissioners put their heads together and broke out a contingency plan to make up for the CSR losses.

This plan was first laid out in an issue brief by the HHS Dept’s. Assistant Secretary for Planning & Evaluation (ASPE) in 2015 and was further discussed by analysts at the Urban Institute in 2019.

This contingency plan came to be known within the health insurance industry as…SILVER LOADING.

The carriers first began to calculate how much they expected to have to shell out in CSR payments the following year...and then added that amount to their premiums for the following year instead.

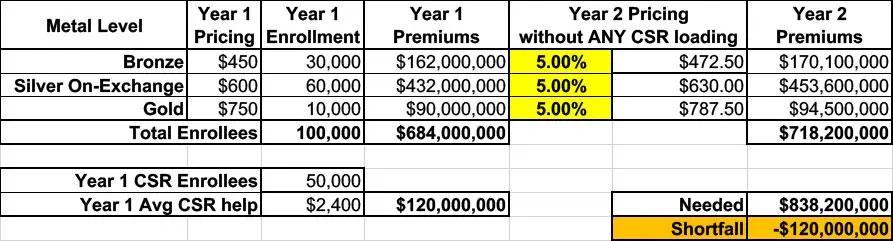

Let’s say in a carrier projected that overall claim expenses the following year would increase by, say, 5%. To keep things simple, let’s say they offered just 3 plans: One Bronze, one Silver (which happens to also be the “benchmark Silver” used to determine subsidies) and one Gold, priced at an average of $450, $600 and $750/month.

This carrier had exactly 100,000 enrollees & had to pay out $120 million in CSR assistance in Year 1.

They assume that total enrollment and their CSR costs will be around the same (and in the same ratios) for Year 2. In other words, this assumes that all 100,000 current enrollees renew their existing policies for another year.

Since the carrier knows they won’t get reimbursed from the federal government for that $120M in CSR costs, raising their premiums by just 5% across the board would mean having to eat a $120 million loss. Ouch:

So, what did they start doing instead?

They loaded their projected CSR losses onto the premiums instead.

Basically, they took the total amount ($120 million), divided that by 12 months ($10 million/month) and then divided that across their projected enrollment to figure out how much to tack onto each enrollee’s monthly premium to make up the difference.

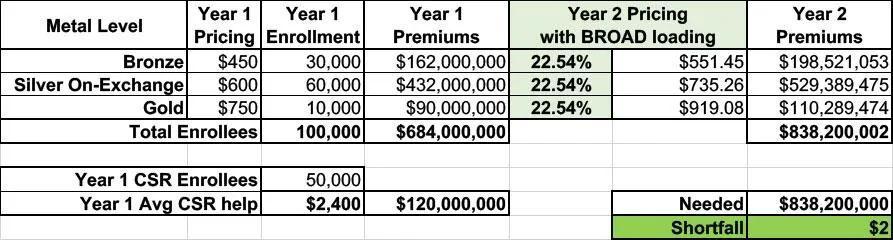

Now, if they simply divided that $10 million/month across all of their enrollees, regardless of the plan, they’d have to raise their premiums for every plan at every metal level by around 22.5% to make up that difference, as shown below.

This is called Broad Loading:

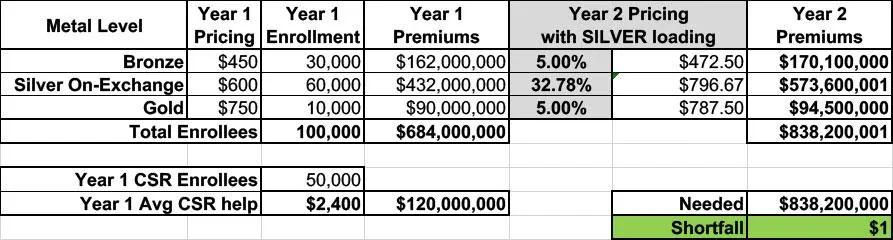

In 2018, some carriers did it this way, but most carriers in most states started doing something else instead: They Silver Loaded.

Silver loading involves concentrating the CSR costs so that they’re only added to the Silver plans on the ACA market (as opposed to Bronze, Gold or Platinum).

This means that instead of every plan going up by 22.5%, the Silver plans would go up 32.8% while the other metal tiers only went up 5%:

The good news is that doing it this way holds the 40% of enrollees in Bronze or Gold plans harmless; they only see their premiums go up by the “normal” amount.

The bad news is that Silver plan enrollees, who make up the bulk of all ACA enrollees, are royally screwed, right?

Well...no. Those who are unsubsidized are indeed screwed--they have to either downgrade to a Bronze plan or upgrade to a Gold plan to avoid getting hit with that 33% rate hike (in the latter case, notice that the Gold plan actually costs less at full price now even with the lower deductible...it’s now a better value!)

However, the vast majority of exchange enrollees receive APTC subsidies...and the formula for those subsidies are based on the price of the 2nd lowest-cost Silver plan...but they can be applied towards any plan.

Are you still with me? Good.

This is important for two reasons:

First, it means that subsidized Silver plan enrollees see their subsidies increase by roughly the same rate that the premiums increased: Silver premiums go up ~33%, APTC subsidies go up ~33%. So Silver enrollees end up paying pretty much the same amount either way.

More importantly, however, notice again that the Gold plan now costs LESS than the Silver plan...but the subsidies have still gone up as much as the Silver plan!

Let’s say an enrollee qualified for $400/month in APTC in Year 1 (because the maximum they have to pay for the benchmark Silver is $200/month). In Year 2, their APTC would increase from $400/mo to $597/month...but they can use that $597/mo for any plan.

The Silver still costs them $200/mo, but suddenly the Gold plan, which would have cost $350/mo in Year 1, only costs $190/mo in Year 2!

Alternately, the Bronze plan, which would have cost them $50/mo in Year 1, will cost nothing in Year 2 since the APTC amount is actually more than the full-priced Bronze premium.

This is a simplified version of Silver Loading, of course, but the point is that SILVER LOADING MAKES BRONZE PLANS DIRT CHEAP AND CAN MAKE GOLD PLANS COST THE SAME OR EVEN LESS THAN SILVER.

So, what would reinstating CSR payments (as Dr. Oz is proposing) actually do?

It would indeed reduce average gross premiums for ACA plans by around 11% or so, as he notes...but in the process would also substantially reduce subsidies while simultaneously making NET premiums for Bronze, Gold & Platinum plans COST FAR MORE.

Here’s a breakout of 2025 ACA exchange enrollment by metal level and income bracket:

...and here’s the same table with the enrollees who were helped by Silver Loading (in yellow) vs. those who were be “harmed“ by it (in green).

And again, the only reason they’re harmed at all is BECAUSE OF the enhanced subsidies ending, since that immediately cut everyone earning over 400% FPL from receiving any financial assistance at all:

In other words, funding CSR reimbursement payments would slightly help a few hundred thousand middle-class enrollees (who, ironically, only need the help in the first place due to the enhanced tax credits expiring ) while significantly harming over 5.7 million lower-income enrollees in the process by causing their net premiums to skyrocket.

The bottom line: Don’t mess around with CSR.

-----

UPDATE: I forgot about that strange "83% subsidy" comment that Oz starts off with above:

"...there was a baseline 83 percent subsidy, that, when you take away the extra 5 percent, which is what the enhanced premium subsidies represent, it doesn't really affect enrollment."

I'm not quite sure what Oz is talking about here. I think this refers to the average percentage of total ACA exchange premiums which are paid for by the Advance Premium Tax Credits (APTC); according to the 2025 CMS Public Use Files:

- Unsubsidized monthly premium for ACA exchange plans averaged $619/mo nationally last year

- There were 24,319,713 people who selected plans during 2025 Open Enrollment

- That would theoretically mean total premiums of $180,646,828,164 for 2025, assuming 100% of them were enrolled in the same plan year round (which of course never happens)

- Average APTC among those receiving subsidies was $550/month

- 22,380,137 OEP enrollees received APTC, for total APTC of $147,708,904,200

- That would mean APTC covered around 81.8% of total premiums in 2025

Assuming this is what Oz is referring to, 81.8% is pretty close to 83%, and the vagaries of attrition over the course of the year/etc could mean 83% is the actual percent.

HOWEVER...that still wouldn't explain him claiming that the enhanced tax credits only make up 5% of the total, given that the CBO projected the enhanced subsidies would cost $24.6 billion this year...which would be over 15% of total APTC.

So no, I have no idea what he's talking about here either.

How to support my healthcare wonkery:

1. Donate via ActBlue or PayPal

2. Subscribe via Substack.

3. Subscribe via Patreon.